Unknown Facts About Tulsa Debt Relief Attorney

Unknown Facts About Tulsa Debt Relief Attorney

Blog Article

The Buzz on Chapter 7 Vs Chapter 13 Bankruptcy

Table of ContentsEverything about Tulsa Bankruptcy ConsultationChapter 7 - Bankruptcy Basics Things To Know Before You BuySome Known Details About Tulsa Ok Bankruptcy Specialist The 3-Minute Rule for Tulsa Ok Bankruptcy SpecialistAn Unbiased View of Chapter 7 Bankruptcy Attorney TulsaThe smart Trick of Chapter 7 Vs Chapter 13 Bankruptcy That Nobody is Discussing

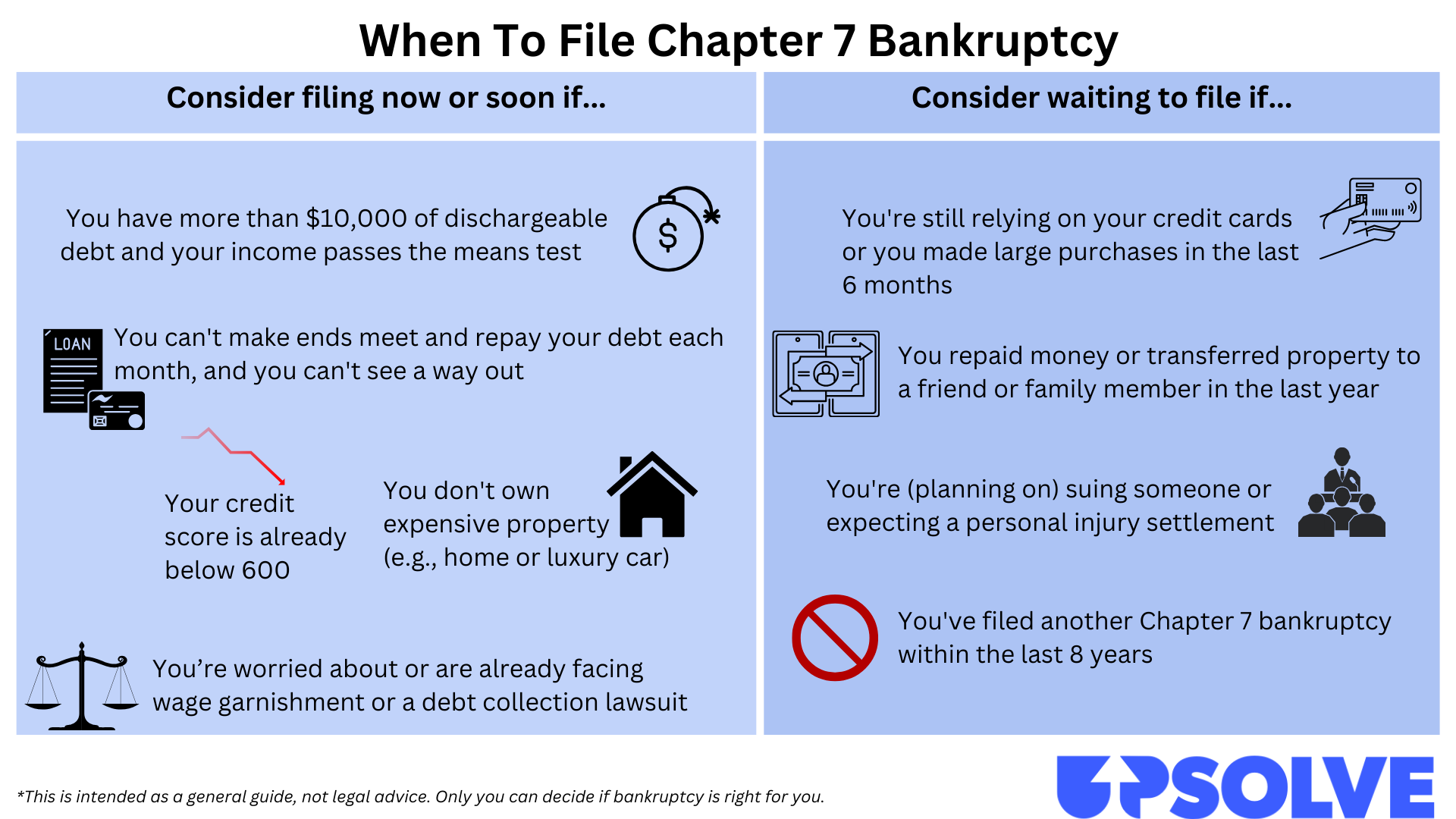

People have to use Chapter 11 when their financial debts exceed Phase 13 debt limits. It hardly ever makes good sense in other circumstances however has much more options for lien removing and cramdowns on unsafe sections of secured lendings. Chapter 12 insolvency is made for farmers and fishermen. Chapter 12 payment strategies can be much more flexible in Chapter 13.The methods examination considers your average regular monthly earnings for the 6 months preceding your filing date and compares it versus the typical income for a similar household in your state. If your earnings is below the state mean, you immediately pass and do not need to finish the entire form.

If you are married, you can file for personal bankruptcy collectively with your partner or individually.

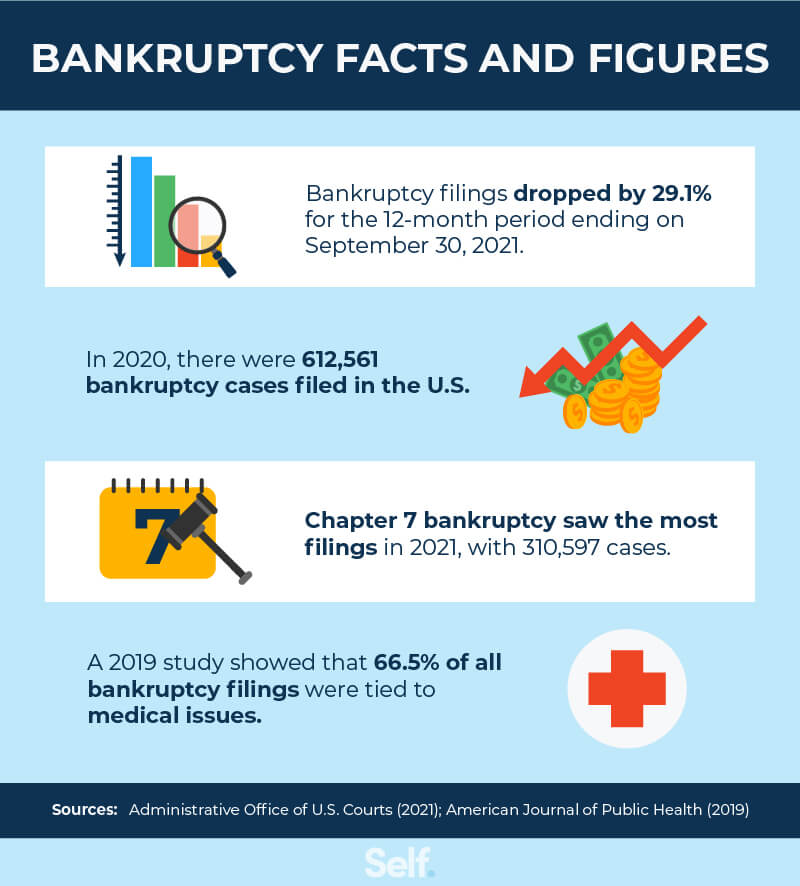

Filing personal bankruptcy can help an individual by disposing of financial debt or making a plan to settle debts. A personal bankruptcy case usually starts when the borrower submits a request with the insolvency court. There are different kinds of personal bankruptcies, which are normally referred to by their chapter in the United state Insolvency Code.

If you are encountering economic difficulties in your individual life or in your service, opportunities are the idea of filing bankruptcy has actually crossed your mind. If it has, it also makes good sense that you have a great deal of personal bankruptcy questions that need responses. Lots of people in fact can not respond to the question "what is insolvency" in anything except basic terms.

If you are encountering economic difficulties in your individual life or in your service, opportunities are the idea of filing bankruptcy has actually crossed your mind. If it has, it also makes good sense that you have a great deal of personal bankruptcy questions that need responses. Lots of people in fact can not respond to the question "what is insolvency" in anything except basic terms.Lots of people do not understand that there are several kinds of personal bankruptcy, such as Phase 7, Chapter 11 and Phase 13. Each has its advantages and obstacles, so understanding which is the very best option for your present scenario as well as your future healing can make all the difference in your life.

The Only Guide for Tulsa Bankruptcy Attorney

Phase 7 is called the liquidation insolvency chapter. In a chapter 7 bankruptcy you can remove, eliminate or release most types of financial debt. Examples of unsafe debt that can be cleaned out are credit score cards and clinical bills. All kinds of people and business-- people, married pairs, corporations and collaborations can all file a Phase 7 bankruptcy if eligible.

Several Chapter 7 filers do not have much in the way of possessions. They might be tenants and have an older vehicle, or no auto whatsoever. Some live with moms and dads, good friends, or brother or sisters. Others have residences that do not have much equity or are in significant demand of repair work.

Creditors are not permitted to pursue or keep any type of collection activities or claims during the situation. A Chapter 13 personal bankruptcy is very powerful due to the fact that it offers a mechanism for debtors to stop repossessions and constable sales and stop foreclosures and energy shutoffs while Learn More catching up on their secured financial obligation.

Not known Facts About Tulsa Bankruptcy Attorney

A Phase 13 case may be useful because the borrower is allowed to get captured up on home mortgages or car fundings without the threat of repossession or repossession and is permitted to maintain both exempt and nonexempt residential or commercial property. The borrower's strategy is a document outlining to the insolvency court just how the debtor proposes to pay existing expenditures while repaying all the old financial debt balances.

It gives the borrower the opportunity to either offer the home or become captured up on home mortgage settlements that have actually fallen back. An individual submitting a Chapter 13 can propose a 60-month strategy to cure or come to be existing on mortgage payments. If you fell behind on $60,000 worth of home mortgage repayments, you could suggest a strategy of $1,000 a month for 60 months to bring those mortgage settlements current.

It gives the borrower the opportunity to either offer the home or become captured up on home mortgage settlements that have actually fallen back. An individual submitting a Chapter 13 can propose a 60-month strategy to cure or come to be existing on mortgage payments. If you fell behind on $60,000 worth of home mortgage repayments, you could suggest a strategy of $1,000 a month for 60 months to bring those mortgage settlements current.The Of Tulsa Bankruptcy Filing Assistance

Sometimes it is better to prevent bankruptcy and work out with financial institutions out of court. New Jacket also has an alternate to personal bankruptcy for businesses called an Task for the Benefit of Creditors and our law practice will review this choice if it fits as a potential approach for your service.

We have created a tool that assists you pick what phase your documents is most likely to be submitted under. Click here to utilize ScuraSmart and discover a possible service for your debt. Lots of people do not recognize that there are several kinds of bankruptcy, such as Chapter 7, Phase 11 and Phase 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we handle all kinds of insolvency situations, so we have the ability to answer your personal bankruptcy inquiries and aid you bankruptcy lawyer Tulsa make the very best choice for your situation. Here is a short consider the financial debt alleviation alternatives readily available:.

The smart Trick of Chapter 7 - Bankruptcy Basics That Nobody is Discussing

You can only submit for personal bankruptcy Prior to filing for Chapter 7, a minimum of one of these ought to be real: You have a great deal of financial debt income and/or properties a financial institution can take. You lost your chauffeur license after being in an accident while without insurance. You need your certificate back (Tulsa bankruptcy attorney). You have a great deal of debt close to the homestead exemption amount of in your house.

The homestead exemption amount is the greater of (a) $125,000; or (b) the area typical sale cost of a single-family home in the coming before schedule year. is the quantity of money you would maintain after you sold your home and repaid the home loan and other liens. You can locate the.

Report this page